Unlocking and Enhancing Financial Insights through Generative AI

Client Overview

Our client, a mid-sized financial management company, provides a range of financial services, including investment advisory, wealth management, and financial planning. Their operations involve handling vast amounts of financial data stored in a SQL Server database. Accessing, analyzing, and visualizing this data efficiently was crucial for supporting the firm’s decision-making processes.

Business Challenge

The firm faced several challenges related to data access and interpretation:

-

Dependency on Technical Staff: Non-technical users often needed the assistance of IT or data analysts to write SQL queries and interpret the results.

-

Time-Consuming Processes: Retrieving data and generating insights involved multiple steps, leading to delays.

-

Limited Visualization Tools: The team lacked a streamlined method for creating visual representations of financial data to support discussions and presentations.

The objective was to implement a user-friendly solution allowing team members to input natural language queries and instantly retrieve:

-

Relevant data extracts

-

Corresponding SQL queries

-

Graphical representations of the data

The solution needed to integrate seamlessly with Microsoft Teams, the client’s primary collaboration platform.

Solution Overview

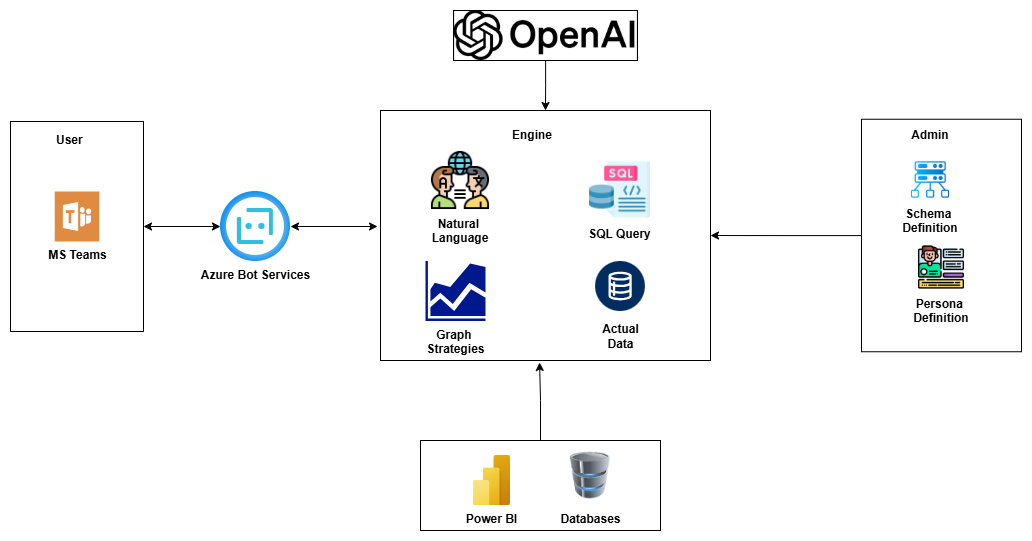

To address these challenges, we designed and implemented a comprehensive solution leveraging cutting-edge AI and data visualization technologies. The solution comprised the following components:

-

Microsoft Teams Bot Interface:

- We developed a bot integrated into Microsoft Teams, allowing users to interact with the system using natural language queries.

-

AI-Powered Query Translation Pipeline:

- The pipeline, deployed on a Red Hat Enterprise Linux 8 (RHEL8) server, utilized OpenAI’s API and the LangChain library to translate user queries into precise SQL statements.

-

Data Retrieval and Analysis:

- The generated SQL queries were executed against the SQL Server database to fetch the requested data.

-

Graph Dimension Generation:

- The pipeline used the OpenAI API to determine appropriate graph dimensions based on the retrieved data.

-

Power BI Integration:

- Visualizations were created using Power BI and embedded directly into Teams bot response cards, ensuring immediate accessibility.

-

Persona and Access-Based Data Retrieval:

- The system incorporated persona-based and access-based data filtering, ensuring that users only received data and visualizations appropriate to their roles and permissions. This feature enhanced security and compliance by restricting access to sensitive financial information.

-

Administrative Configuration Interface:

- An admin page enabled administrators to define business-specific nuances and customize the data schema used by the AI models. This improved the relevance and accuracy of the SQL queries generated.

Implementation Details

The solution’s architecture was designed for robustness, scalability, and seamless user experience:

-

Bot Development:

- We utilized Azure Bot Service to create an intuitive interface for natural language interactions.

-

AI Model Integration:

- The LangChain library facilitated interaction between the natural language input and SQL generation process, leveraging OpenAI’s GPT models for language understanding and SQL translation.

-

Data Processing Pipeline:

- The pipeline was built to ensure efficient query execution and data handling on the SQL Server database, maintaining optimal performance.

-

Visualization:

- The OpenAI API provided graph dimensions, which were dynamically fed into Power BI to generate visualizations tailored to the data’s characteristics.

-

Persona-Based Access Control:

- The bot dynamically adapted its responses based on user roles, ensuring personalized and secure data access.

-

Custom Admin Interface:

- The admin interface was built with flexibility, allowing dynamic updates to data schemas and business rules without disrupting operations.

Outcomes and Benefits

The deployment of this solution brought transformative benefits to the financial management firm:

-

Enhanced Data Accessibility:

- Non-technical team members could easily retrieve data and visualizations, significantly reducing dependency on technical staff.

-

Improved Efficiency:

- The streamlined process reduced the time required to access and analyze data, enabling faster decision-making.

-

User Adoption and Satisfaction:

- The integration with Microsoft Teams ensured high adoption rates and user satisfaction, as employees could use a familiar platform without requiring additional training.

-

Enhanced Security and Compliance:

- Persona and access-based data retrieval ensured secure and role-appropriate access to sensitive financial data.

-

Scalable and Flexible Solution:

- The modular architecture allows for easy updates, scalability, and adaptation to future business needs.

-

Actionable Insights:

- Instant access to data visualizations enabled the team to derive actionable insights more effectively.

Future Prospects

Looking ahead, the solution holds immense potential for further enhancements and applications:

-

Integration with Advanced Analytics Tools:

- Incorporating machine learning models to provide predictive analytics and trend forecasting directly within the bot interface.

-

Expanded Data Sources:

- Extending support to integrate data from multiple sources such as cloud-based databases, external APIs, and big data platforms.

-

Enhanced Customization:

- Developing advanced admin tools to allow for deeper customization of AI models and visualizations based on evolving business needs.

-

Natural Language Query Refinements:

- Improving natural language processing capabilities to handle more complex queries and provide nuanced insights.

-

Mobile Accessibility:

- Extending the solution to mobile platforms, enabling users to access data and insights on the go.

-

AI-Driven Recommendations:

- Implementing AI algorithms to offer proactive recommendations and insights based on historical data and user behavior.

-

Industry Expansion:

- Adapting the solution for other industries such as healthcare, retail, and manufacturing, where data-driven decision-making is critical.

Conclusion

By integrating generative AI with Microsoft Teams and Power BI, we delivered a solution that democratizes data access, simplifies complex processes, and enhances productivity. The incorporation of persona-based and access-based data retrieval further ensured security and compliance. This case demonstrates the transformative potential of AI-driven solutions in financial management and underscores our commitment to empowering businesses with innovative technology.

Key Takeaways:

-

Leveraging natural language processing and AI for SQL generation bridges the gap between technical and non-technical users.

-

Seamless integration with existing tools like Microsoft Teams ensures high usability and adoption.

-

Advanced visualizations provide actionable insights, driving better decision-making.

-

Persona-based and access-based controls enhance data security and ensure compliance.

This project exemplifies how generative AI can revolutionize operations in data-intensive industries, setting a benchmark for innovation and efficiency.